4 Easy Facts About Mileagewise - Reconstructing Mileage Logs Described

4 Easy Facts About Mileagewise - Reconstructing Mileage Logs Described

Blog Article

Mileagewise - Reconstructing Mileage Logs Can Be Fun For Everyone

Table of ContentsThe Only Guide to Mileagewise - Reconstructing Mileage LogsSome Known Details About Mileagewise - Reconstructing Mileage Logs The Definitive Guide to Mileagewise - Reconstructing Mileage LogsAn Unbiased View of Mileagewise - Reconstructing Mileage LogsGetting My Mileagewise - Reconstructing Mileage Logs To Work7 Easy Facts About Mileagewise - Reconstructing Mileage Logs Described

We'll dive into each further. Company mileage trackers are important to a cents-per-mile repayment program from a couple easy reasons. Initially, workers won't receive their compensations unless they send gas mileage logs for their service trips. Second, as previously mentioned, while by hand recording mileage is an option, it's time consuming and reveals the company to mileage fraud.FAVR repayments are specific to each private driving staff member. With the ideal supplier, these prices are computed via a platform that attaches service gas mileage trackers with the information that guarantees fair and exact gas mileage repayment.

This confirms the allocation amount they receive, ensuring any type of amount they receive, up to the IRS gas mileage rate, is untaxed. This additionally secures business from potential gas mileage audit risk., additionally referred to as a fleet program, can't perhaps have requirement of a business mileage tracker?

Mileagewise - Reconstructing Mileage Logs Can Be Fun For Anyone

, "A worker's personal usage of an employer-owned car is thought about a part of a staff member's taxable income" So, what takes place if the staff member doesn't maintain a record of their organization and personal miles?

The majority of company gas mileage trackers will certainly have a handful of these attributes. At the end of the day, it's one of the most significant benefits a firm obtains when adopting a service gas mileage tracker.

What Does Mileagewise - Reconstructing Mileage Logs Mean?

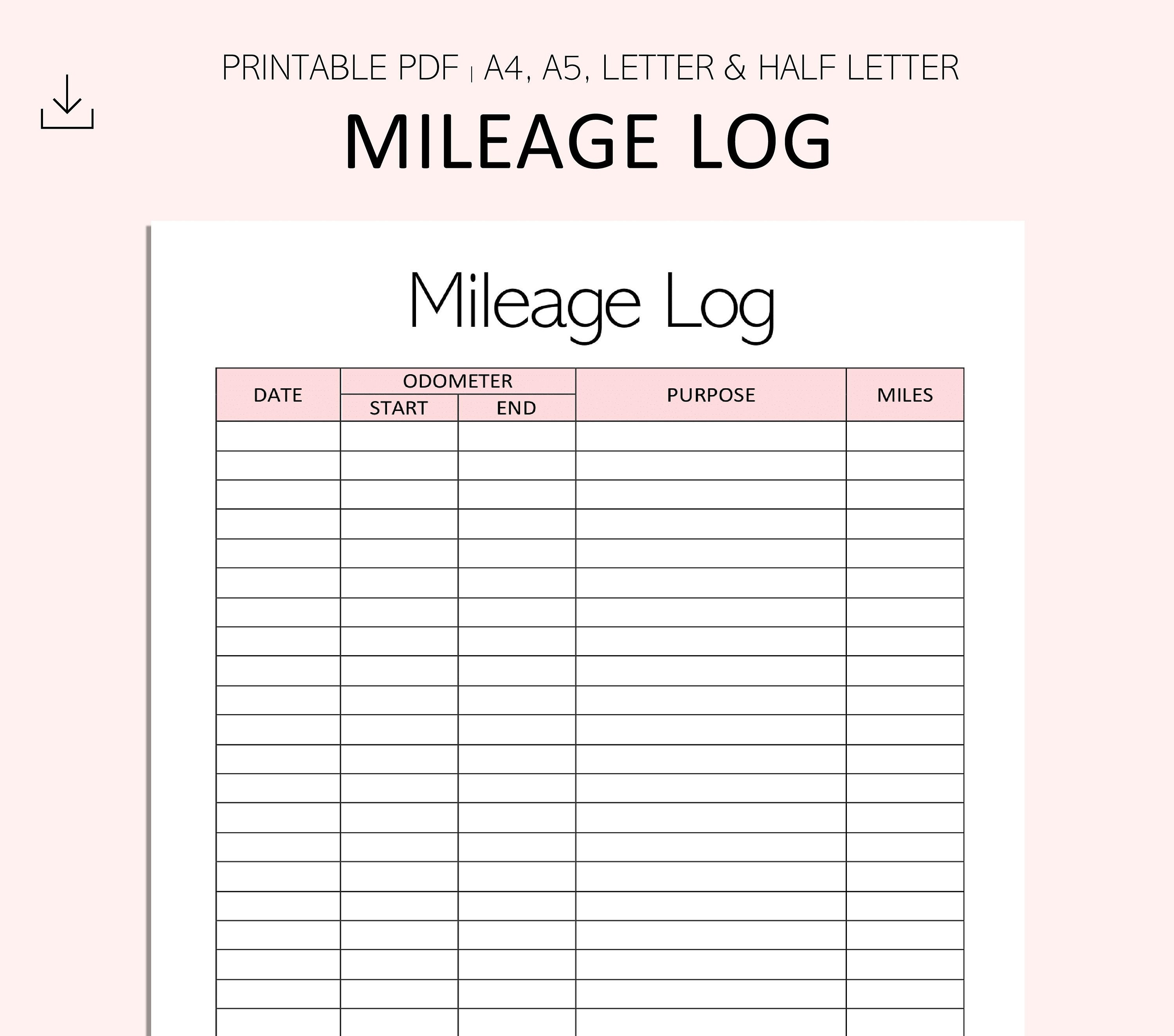

(https://www.pubpub.org/user/tess-fagan)If the tracker permits workers to send incomplete mileage logs, after that it isn't carrying out as required. Locations, times, odometer document, all of that is logged without additional input.

Mobile employees can add this details at any time prior to submitting the gas mileage log. Or, if they tape-recorded an individual trip, they can eliminate it. Submitting gas mileage logs with a company gas mileage tracker ought to be a wind. Once all the details has been included correctly, with the finest tracker, a mobile employee can submit the gas mileage log from anywhere.

Getting The Mileagewise - Reconstructing Mileage Logs To Work

Can you envision if a company mileage tracker application caught each and every single journey? Occasionally mobile employees simply neglect to transform them off. There's no harm in capturing individual trips. Those directory can conveniently be deleted prior to submission. But there's an also simpler solution. With the ideal mileage monitoring app, companies can establish their working hours.

The Buzz on Mileagewise - Reconstructing Mileage Logs

This application functions hand in hand with the Motus system to make certain the precision of each gas mileage log and repayment. Where does it stand in terms of the ideal gas mileage tracker?

Fascinated in finding out more concerning the Motus application? Take a scenic tour of our application today!.

6 Easy Facts About Mileagewise - Reconstructing Mileage Logs Shown

We took each app to the field on a the same path during our strenuous screening. We evaluated every monitoring setting and turned off the net mid-trip to attempt offline mode. Hands-on screening enabled us to examine use and figure out if the app was very easy or difficult for staff members to use.

: Easy to useAutomatic mileage trackingMinimum tracking rate thresholdSegmented tracking Easy to generate timesheet records and IRS-compliant mileage logsOffline setting: Advanced tools come as paid add-onsTimeero covers our list, many thanks to its ease of usage and the efficiency with which it tracks gas mileage. You don't require to buy expensive gizmos. Just demand employees to mount the mobile app on their iphone or Android mobile phones and that's it.

Report this page